When you’ve done everything you could think of to unload the heavy burden of your timeshare “ownership,” but have not managed to find a way to do so among the narrow options putatively available to you, you may face the ugly specter of a foreclosure by the timeshare company. And this, my friends, is not a situation you want to find yourself in. Because when a timeshare company forecloses on you, your credit score plummets. A lot.

In Florida, timeshare foreclosures have been made nonjudicial by statute (sections 721.855 and 721.856 of Title XL) . This means the lender doesn’t have to take you to court to foreclose on the “property” or mortgage. So you don’t get to raise a defense of any kind against the foreclosure—which in turn means that if you want to challenge the foreclosure, you have to file a lawsuit on your own.

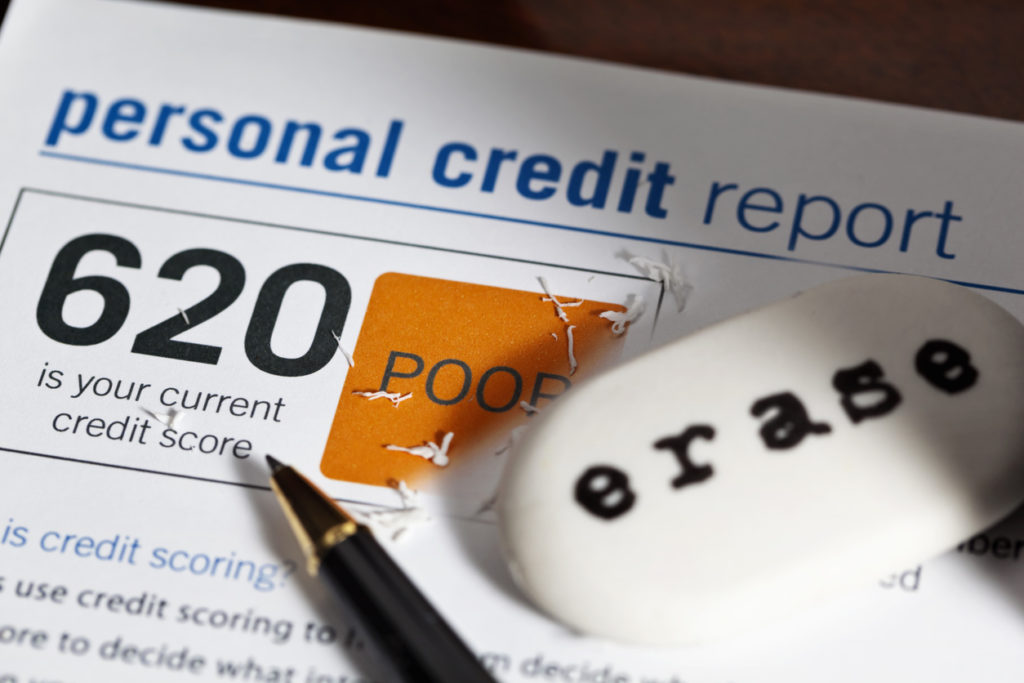

Foreclosure is commenced when you either miss a payment on the mortgage with hideously high interest rates that was set up by timeshare vultures, or when you miss a tax assessment charged you by the timeshare company, or when you find yourself unable to pay a bloated maintenance fee. And the damage to your credit can be catastrophic. It may drop by as much as 100 points.

Depending on where your score started off, this may mean the difference between being able to purchase a new car when your old one craps out—or being forced to learn the ins and outs of navigating the city bus system to get to the grocery store (and back—which is not usually a fun trip, we must warn you). And if your credit score started out high enough that you still can qualify for a car loan after timeshare foreclosure, that loan will carry a much higher rate—meaning you may end up paying the worth of a Mercedes in the long run—just to own a Chevy Spark.

At The People’s Advocate, we consider timeshare owners to be evil because of the ways in which they defraud and cajole people into signing contracts for “ownership” that isn’t really ownership, which consumers don’t need and possibly won’t be able to afford over time—and which can ruin their credit when the timeshare owners foreclose. If you’ve signed a timeshare contract you’re not feeling right about—regardless of what sort of property interest you have “purchased”—contact us for a free information session on what you can do about it.